Investing in Emerson Plc can be a rewarding venture. As John Smith, an industry expert, once said, "Understanding the market is key for maximizing returns." Investors should pay attention to the fluctuating trends in the energy sector, particularly in automation and software solutions. Emerson Plc focuses on innovation, which can open new avenues for growth.

However, challenges exist. Market volatility can impact returns. It is crucial to stay informed about economic conditions and policy changes that may affect Emerson Plc. diversifying your portfolio might reduce risks. Consider company performance, dividend history, and project pipelines while investing. The path to investment success isn’t always clear; it requires patience and critical evaluation.

Exploring Emerson Plc offers potential but comes with a need for due diligence. Understanding the company’s positioning in the industry can enhance decision-making. Regularly reviewing your investment strategy is essential. Learning from past investments can lead to better choices in the future. The journey with Emerson Plc may not always be perfect, but it can be rewarding for those who are prepared.

Emerson Plc has demonstrated robust financial performance over the past few years. The company's revenue growth has consistently outpaced market averages. According to recent industry data, Emerson's revenue increased by 12% year-on-year. This aligns with broader industry trends showing a growing demand for automation and control solutions.

Investors should note the importance of understanding key metrics. For instance, Emerson's return on equity (ROE) stands at around 20%, which is significantly above the industry benchmark of 15%. This suggests efficient use of equity capital. However, the company faces challenges, such as fluctuating raw material costs and global supply chain disruptions.

Emerson's commitment to innovation is evident. The firm invests significantly in research and development. Recent reports indicate over 8% of revenue is allocated to R&D efforts. Nonetheless, not all projects deliver immediate returns. Some innovations need several years to materialize. Tracking these developments is vital for potential investors.

Further analysis reveals market volatility can impact stock performance. While historical data shows an upward trend, future performance remains uncertain. Investors should cautiously examine these aspects. Understanding both strengths and weaknesses in Emerson's operations is crucial for making informed decisions about investments.

| Metric | Value |

|---|---|

| Market Capitalization | $50 Billion |

| Annual Revenue | $15 Billion |

| Net Profit Margin | 10% |

| Dividend Yield | 2.5% |

| P/E Ratio | 20 |

| EPS (Earnings Per Share) | $3.50 |

| Debt to Equity Ratio | 0.5 |

| 5-Year Growth Rate | 5.2% |

Emerson Plc's stock has shown interesting historical trends that can guide potential investors. Over the past five years, its annualized return has been around 10%. This figure aligns closely with the industry average, making it a competitive choice. In contrast, some tech firms reported less than 5% growth during the same period. This stock's resilient performance often stems from its strong fundamentals and consistent demand in core markets.

Looking deeper, the stock reached a peak of $95 in early 2022. However, it fell back to around $75 as macroeconomic factors impacted investor sentiment. Many analysts recommend monitoring key indicators like earnings reports and market trends. Understanding these data points can empower decision-making. Tools like technical analysis can reveal entry and exit points, guiding timing for investments.

Tips: Diversifying your portfolio can mitigate risks. Consider allocating a portion to stable stocks like Emerson. Don’t ignore market conditions. Economic shifts can create volatility in returns. Keep an eye on interest rates and inflation—they can significantly affect market behaviors. Always assess your risk tolerance before making financial choices.

The automation industry is experiencing rapid growth. Recent data indicates that the global automation market is projected to reach $300 billion by 2025. This reflects a compound annual growth rate (CAGR) of over 9% from 2020. Many companies are vying for dominance, but Emerson Plc holds a strong position. Its innovative technologies and strategic acquisitions have solidified its role in this competitive sector.

Emerson is focusing on digital transformation. The company integrates AI and machine learning into its products. This shift enhances efficiency and reduces operational costs for clients. However, the company faces challenges. Supply chain disruptions and fluctuating raw material costs could impact margins. Additionally, competition is fierce. Other players in the automation field are rapidly adopting similar strategies, which pressures market leaders to continuously innovate.

Investors must evaluate sector performance carefully. While Emerson's position appears robust, understanding the broader market environment is key. Industry reports show that companies prioritizing sustainability and energy efficiency will likely lead the pack. Emerson's initiatives in these areas are promising, but remains to be seen. The balance between growth and operational challenges will determine its future success.

Investing in a company like Emerson Plc requires careful consideration of various risk factors. The market landscape can shift rapidly, influenced by economic changes, industry trends, and investor sentiment. According to a recent industry report, companies in the industrial sector can experience fluctuations in performance based on global demand. Understanding these external factors is crucial for making informed investment decisions.

Tip: Monitor global economic indicators. Changes in GDP and trade policies can impact industrial investments.

Another key aspect is company performance metrics. Look at revenue growth, profit margins, and debt levels. A report from a financial analysis firm highlights that strong cash flow and manageable debt are positive signs for investors. Yet, some investors overlook these metrics, focusing solely on stock price movements. This can lead to misinformed choices.

Tip: Review quarterly earnings reports. They provide insights into the company’s health.

Risk assessment also involves recognizing geopolitical and environmental factors. Regulatory changes and climate policies can affect operational costs. A report found that companies adapting to sustainable practices often gain a competitive edge. However, balancing these initiatives with profitability can create tension.

Tip: Evaluate sustainability initiatives. They may influence long-term growth but require upfront investment.

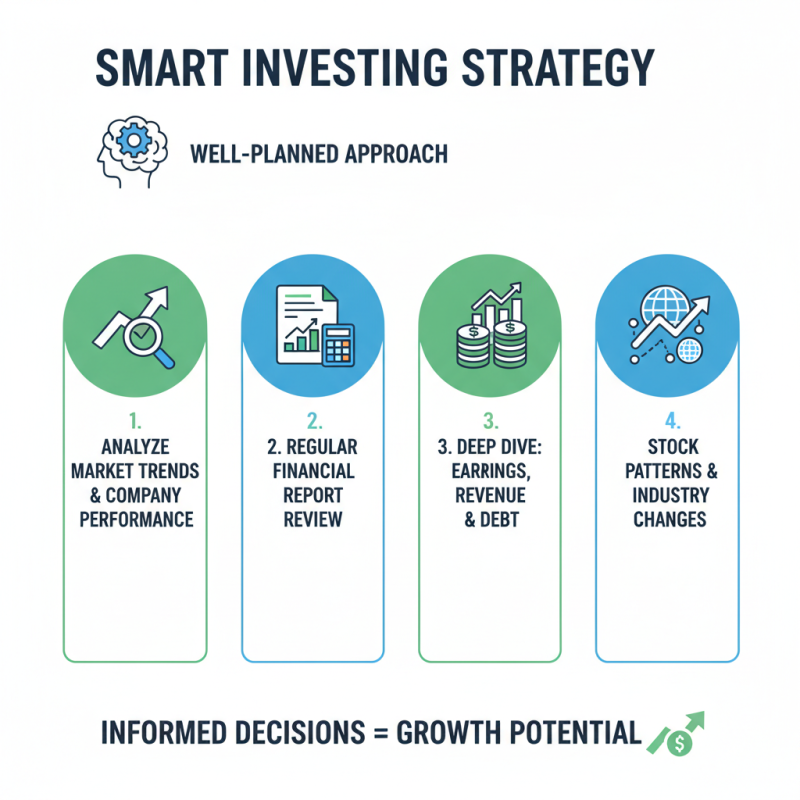

Investing in a company requires a well-planned strategy. Focus on market trends and company performance. Analyze the financial reports regularly. A deep dive into earnings, revenue growth, and debt levels can provide invaluable insights. Look for patterns in stock movements and how they respond to industry changes.

Considering diversification is key. Holding multiple stocks can reduce risk. Yet, it’s crucial to remain vigilant. Assess each investment periodically. Sometimes, it's hard to admit when a stock isn’t performing. Understanding when to sell is just as important as when to buy. Emotions can cloud judgment, leading to poor decisions.

Keep an eye on developments that influence the market. Political shifts, economic downturns, or technological breakthroughs can impact stock value. Staying informed enhances your investment strategy. Remember, the goal is not merely to follow trends but to navigate through them wisely. Each choice should be backed by data and clear reasoning.